May 17, 2024 By Triston Martin

Handyman insurance coverage may help reduce the danger of legal action, property damage, medical expenses for unintended injuries to third parties, and other hazards. Moreover, it encompasses a wide range of small business insurance options.

General liability insurance, often called handyman-insured liability insurance, is the most typical coverage; however, commercial property, tools, equipment, workers' compensation, and commercial car policies are also typical. Now, let us read further to acknowledge the top handyman insurance providers.

Next

Despite the abundance of self employed handyman insurance providers, next Insurance's simplified solutions may help small company owners like handymen. Everyones top choice is Next Insurance since it offers inexpensive, adequate coverage and makes receiving a quotation and monitoring your insurance straightforward.

NEXT handyman and contractor insurance usually covers general liability and mistakes and omissions. Handymen might cover tools, equipment, workers' comp, and commercial vehicles. Buying several insurance may save you 10%.

Next, Insurance's same-day coverage and cheap handyman insurance proof streamline the policy-buying process. Unlike other business insurance, Next Insurance lets you file claims online or by phone. Many cases are settled daily.

Next, insurance offers fewer customization possibilities than other insurance options. However, the coverage should be sufficient for most humans. Insurance can provide licenses in all states; however, certain communities may limit specific policies.

Simply Business

Due to its quotation, policy purchase, and policy management features, Simply Business is the best handyman-insured insurance broker. Free quotations from leading suppliers are received within 10 minutes by the broker for comparison. Adjust limits and deductibles to fit your requirements.

Simply Business's biggest issue is that the broker is only available during business hours and has no app. Commercial property and other coverages need a phone call to an agent, although workers' comp and liability may be purchased online. Our top self employed handyman insurance provider, Next Insurance, has an app for policy administration and can swiftly issue and distribute company certificates of insurance (COIs).

Simply Business gave us five estimates to get the best handyman business insurance, including Hiscox. Insurance costs averaged $977 per year. Monthly payment options were not disclosed. The cheap handyman insurance bids included a maximum of $1 million in general liability but not tool coverage. Contact Simply Business anytime to discuss inland marine or commercial property insurance and general liability.

State Farm

Everyone is prepared for the difficulties of running a company, particularly when figuring out complicated insurance policies. By only selling insurance via neighborhood agents who consult one-on-one with company owners, State Farm adopts a distinctive strategy for small business insurance. With this personal care insurance, State Farm is recognized for providing excellent service.

State Farm has more customizable coverage choices than most self employed handyman insurance companies, allowing you to customize your policy to meet your company's unique requirements. Having general liability insurance with optional professional liability coverage for after-project coverage may be advantageous for handymen.

The provider's website needs to offer more useful information about the full range of the coverages provided since State Farm representatives custom-build small business policies. Chatting with a local State Farm representative can only get a quotation. Fortunately, agents are in every state, so the best thing to do is find your alternatives.

Even if you drive your car to handyman assignments, business auto insurance coverage is important. If you are involved in an accident while working, you will probably be responsible for paying for the damages since most personal auto insurance doesn't cover business-related activities. The greatest option for locating the appropriate coverage is State Farm Business, the biggest cheap handyman insurance in the US.

Progressive

Vehicles of almost any kind that you would use to carry your equipment and yourself to tasks are covered by Progressive Commercial's insurance, including automobiles, trucks, and vans. Liability, comprehensive, collision, uninsured/underinsured motorist, and other coverages are available. Progressive Commercial also provides coverage for towing a trailer. Handymans may get self employed handyman insurance from Progressive for personal and professional car usage to guarantee no coverage gaps.

The insurer claims that the average monthly vehicle premium for contractors is $186, which indicates that the prices are modest. Combining business car insurance with general liability coverage may save money in several ways, such as bundling. Business clients may also use Progressive's safe driving software, Snapshot, to save 5% when they sign up and as much as 18% depending on how they drive.

Progressive Commercial offers many forms of cheap handyman insurance for small businesses, most of which external entities underwrite. You could discover that there are fewer options to personalize coverage even if these plans provide the fundamental protection you want as a handyman.

BiBERK

BiBERK immediately distinguishes itself as a more affordable insurance choice for budding small company owners by touting rates up to 20% less than its rivals. General liability, workers' compensation, business vehicle, and umbrella insurance are among the handyman-insured insurance options suggested by the firm. Additionally, biBERK offers cyber insurance and company owner plans. Similar to NEXT, biBERK provides a rapid online estimate service. Nevertheless, customers who would rather speak with a corporate person may also get a price by phone.

Despite being relatively new, biBERK is backed by subsidiaries rated AA+ by S&P and A++ by AM Best. It is operated as part of the Berkshire Hathaway Insurance Group. Also, the business has a reputation beyond its youth, making it a dependable option for cheap handyman insurance carriers.

BiBERK's greatest drawback is that not all policies are accessible in all states. This may be restrictive as a handyman, particularly if you want to combine several self employed handyman insurances. One insurance may be provided in your state, while another is regrettably unavailable. However, before delving further into BiBERK's rules, check out its coverage map.

Despite its restricted policy reach, BiBERK is still a fantastic option supported by seasoned industry specialists. With its low prices, strong financial standing, and rapid quotation service, BiBERK is our choice for the cheapest handyman-insured insurance.

Final Verdict

Handyman insurance is a no-brainer, with several alternatives beginning under $1 daily. Any of the above firms will support you financially in an emergency. Whether you need help determining whether handyman insurance is right for you.

-

Total Visa Credit Card

Nov 30, 2023

-

Financial Challenges: 5 Credit Card Pitfalls to Avoid in Hard Times

Jan 26, 2024

-

The Art of Financial Optimization: Cheapest to Deliver (CTD) Unveiled

Dec 29, 2023

-

Compare: Rainy Day Fund vs. Emergency Fund

Jan 21, 2024

-

Unlocking the Potential: Investing in Real Estate with Your IRA

Nov 21, 2023

-

Find Out: What Are the Minimum Number of Shares You Can Buy?

Nov 06, 2023

-

How Long Is An Appraisal Good For?

Jan 07, 2024

-

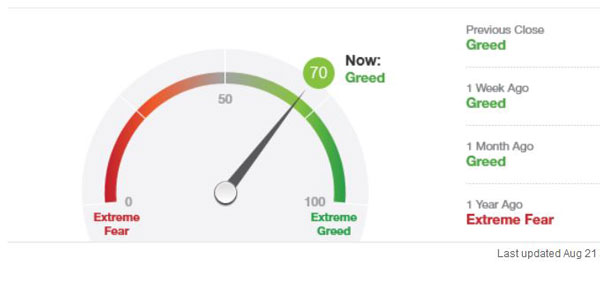

How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023