Jan 28, 2024 By Susan Kelly

Purchasing a home might be a thrilling experience. It's a flurry of paperwork and financial obstacles but also full of potential. Many challenges might be forgotten while signing mortgage paperwork and paying closing expenses, and one of those is setting aside money for unexpected house repairs.

Ilyce Glink, founder of ThinkGlink.com and author of "100 Questions Every First-Time Home Buyer Should Ask," believes that prospective buyers often fail to factor in the ongoing expenses associated with owning and maintaining a home.

Mortgage, taxes, and insurance are important considerations. Still, a larger property comes with more care and maintenance costs, which might put a homeowner over the limit if they are already on the border of affordability.

What Is A Home Maintenance Fund?

Planning to save money for unforeseen home repairs is a great way to ensure you always have the resources you need to keep your house safe and functional. Nobody enjoys fixing a dripping roof or a running toilet. Lisa, who writes as Mad Money Monster, says she was motivated to start saving after a lightning strike.

After lightning hit a neighbour's tree on the fence line, she realized she would need to put money aside for home repairs. Sad to say, it cracked and crashed into my backyard. Curiously, it doesn't matter where the tree's roots are located if it falls into your land.

Fortunately, Lisa says, the tree missed her freshly constructed fence by only a few feet, and her neighbour offered to pay for the cleanup, so the damage from mother nature was completely negligible.

Otherwise, she estimates she would have spent at least $1,000 on repairs and cleanup. She explains, "After that, I vowed to put aside $100 a month just for repairs in case something like that ever happened again."

How Much Should Home Repairs Cost?

When planning a financial strategy to deal with unforeseen house maintenance, it might be helpful to follow some general guidelines. If you follow the "one percent rule," you'll always have at least that much set aside for your home's upkeep, no matter how much it's appreciated.

This amounts to $3,600 per year, or $300 monthly, on a home worth $360,000. "Save 10 per cent of the overall cost of your property taxes, mortgage, and insurance payments," Glink advises as another solid rule of thumb.

It's safe to assume that this is the minimum you'll need to budget. For example, if your monthly tax, mortgage, and insurance payments total $2,000, you should put away an additional $200 for upkeep and repairs.

When Might You Want To Save More?

A home's age determines how much money you should set aside for maintenance and upgrades. Glink recommends saving more than the recommended amount if your home is older or if you anticipate costly repairs shortly.

Don't believe you're exempt from saving for unexpected home repairs because your house is relatively new. Glink is correct in saying that, on average, homeowners don't spend as much time and money repairing their homes within the first five years.

However, this is not always the case, and things like natural disasters and accidents can damage even brand-new houses in ways that homeowners insurance might not cover. Lisa adds, "The tree was a wake-up call because my house was brand new when I bought it and I was not too concerned about having serious difficulties."

Where To Save For House Repairs?

You should put money aside for unexpected house repairs in an easily accessible savings account. When something bad does happen, "you're going to need to get at this cash fast and readily," Glink warns. Don't invest in long-term bonds because you believe the interest rate will rise.

It would help if you looked for the highest interest rate on a bank account guaranteed by the Federal Deposit Insurance Corporation (FDIC).

There are several advantages to planning home repairs and storing the money in a high-interest online savings account. Your money will generate interest while it is in the account, and if the bank fails, your money will be safe up to the maximum amount allowed by law. One advantage of having an online savings account is having access to funds in a sudden household emergency.

It's Time To Save For House Repairs

Owning a home is a huge financial and personal commitment. While it's true that the down payment and closing charges account for the bulk of your expenses, costly maintenance issues might linger long after you've moved in. You may relax and take pleasure in your property without worrying about whether or not you'll have enough money for unforeseen repairs if you set aside a specific amount each month.

-

Discount Brokers vs. Mutual Fund Companies

Oct 10, 2023

-

How To Use 529 Funds To Pay For Overseas Education

Jan 19, 2024

-

How Long Is An Appraisal Good For?

Jan 07, 2024

-

Essentials of Bird Dogging in Real Estate for Beginners and Field Pros

Dec 22, 2023

-

Best Handyman Insurance Companies: Coverage and Client Satisfaction

May 17, 2024

-

Financial Challenges: 5 Credit Card Pitfalls to Avoid in Hard Times

Jan 26, 2024

-

Review of The Gap Visa Card

Dec 04, 2023

-

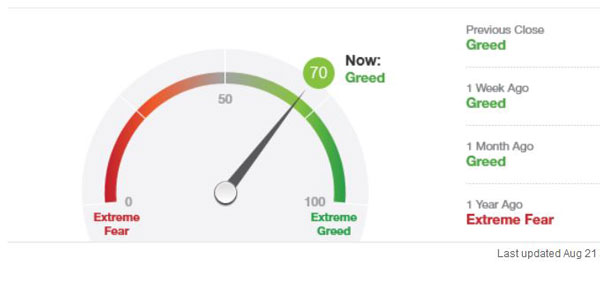

How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023