May 07, 2024 By Susan Kelly

American Fidelity Life Insurance stands as a beacon of financial security and peace of mind for countless individuals and families across the United States. Established with the aim of providing top-notch life insurance products, it distinguishes itself through exceptional customer service, reliable coverage options, and an unwavering commitment to the well-being of its policyholders. This guide seeks to shed light on the various aspects of American Fidelity Life Insurance, from its comprehensive range of products to the intricacies of policy management, aiming to arm potential and existing policyholders with the knowledge they need to make informed decisions about their life insurance needs. Whether you're starting a family, looking to safeguard your future, or simply exploring life insurance options, this guide endeavors to be your go-to resource.

Life Insurance Policies Offered by American Fidelity:

American Fidelity Life Insurance provides a diverse suite of life insurance policies designed to meet the varied needs of its clientele. From term life policies, which offer protection for a specified period, to whole life insurance that provides lifelong coverage plus cash value accumulation, the company ensures there's a fit for everyone's circumstances and financial goals.

Universal life insurance options offer flexible premium payments and the potential for cash value growth, catering to those seeking a balance between long-term investment and insurance. Specialized riders and benefits, including accelerated death benefits and options for critical illness coverage, complement these policies, allowing policyholders to tailor coverage to their unique life situations and providing an added layer of security for their futures.

Navigating Policy Management and Customer Support:

Managing a life insurance policy with American Fidelity goes beyond mere payment of premiums. It encompasses a user-friendly interface for policyholders to monitor and manage their policies online, an approach that prioritizes convenience and accessibility. With features such as online bill payment, policy adjustment capabilities, and easy access to customer service representatives, the company ensures a seamless experience for its customers.

American Fidelity's customer support team is renowned for its responsiveness and expertise, ready to assist with inquiries, provide guidance on policy details, and offer support through life's various transitions. This commitment to effective policy management and exceptional customer service reinforces the company's dedication to its policyholders' satisfaction and peace of mind.

How to Choose the Right Life Insurance Plan for You?

Choosing the right life insurance plan requires careful consideration of your current life stage, financial goals, and the needs of your dependents. Start by assessing your financial obligations, including debts, daily living expenses, and future commitments like college tuition or retirement. Ideally, a plan should cover these costs, ensuring your family's financial stability in your absence. Additionally, consider the policy's term, whether you're seeking temporary protection or a permanent solution that accumulates cash value. Consulting with a financial advisor can provide personalized insights, helping you select a plan that aligns with your objectives, offers adequate coverage, and fits your budget, securing your peace of mind and your family's future.

Benefits of American Fidelity Life Insurance:

- Financial security for your loved ones: With American Fidelity Life Insurance, you can rest assured that your dependents will be financially supported in the event of your passing, providing them with a sense of stability and comfort during a difficult time.

- Cash value accumulation: Certain policies offered by American Fidelity allow for the accumulation of cash value, serving as a form of savings and investment for your future financial goals.

- Flexible coverage options: The company's range of policies and riders offer flexibility, allowing you to customize coverage according to your individual needs and circumstances.

- Exceptional customer service: American Fidelity is committed to providing top-notch customer service, ensuring that policyholders have a positive experience throughout the duration of their policy.

- Peace of mind: With American Fidelity, you can have peace of mind knowing that your loved ones and legacy are protected, allowing you to focus on enjoying life without worries about the future.

Application Process for New Policyholders:

To begin the process of securing a life insurance policy with American Fidelity, you can request a quote online or contact their customer service center. A licensed agent will guide you through the policy options and assist in selecting the right plan for your needs. Once you've chosen a policy, you'll complete an application form and undergo underwriting, which involves a review of your health and lifestyle factors. Upon approval, you'll receive your policy documents and can start managing your coverage through the online portal or by contacting customer service. As with any life insurance policy, it's essential to regularly review and update your coverage as needed to ensure it continues to meet your changing needs.

Managing Your Policy: A Guide for Existing Policyholders:

If you're already a policyholder with American Fidelity, you have access to various resources and support to manage your coverage effectively. The online portal allows for easy bill payment, policy updates, and viewing of important documents. Additionally, the customer service team is always available to assist with any questions or concerns you may have about your policy. It's crucial to regularly review your coverage and make any necessary adjustments to ensure it continues to meet your needs. Life changes, such as marriage, the birth of a child, or purchasing a new home, may warrant updates to your policy to provide adequate protection for those who depend on you.

Dealing with Claims: What Policyholders Need to Know?

In the event of a policyholder's passing, their loved ones can file a claim with American Fidelity to receive the death benefit. The process involves completing a claim form, providing necessary documentation, and notifying the company of the death. Once all requirements are met, American Fidelity will promptly process the claim and distribute the benefit according to the policy's terms. In cases where the policyholder has a cash value accumulation, their beneficiaries may choose to receive either the death benefit or surrender the policy for its cash value. The customer service team is available throughout the claims process to offer guidance and support to grieving families.

Future Planning with American Fidelity Life Insurance: Beyond Basic Coverage:

- Estate planning: Life insurance can play a crucial role in estate planning, protecting your assets and loved ones' inheritance.

- Business succession planning: For business owners, life insurance can serve as a tool for succession planning, ensuring the continuation of the company and providing financial support for family members involved in the business.

- Supplemental retirement income: Certain policies offered by American Fidelity can provide a source of supplemental retirement income, offering financial security for your golden years.

- Charitable giving: Life insurance can also be used as a way to leave a charitable legacy, with the death benefit being donated to a chosen charity or organization.

- Final expenses: In addition to providing for loved ones, life insurance can also cover final expenses such as funeral costs, alleviating any financial burden on family members.

Conclusion:

American Fidelity Life Insurance offers a variety of policies and benefits to provide financial security for individuals and their loved ones. With a focus on exceptional customer service and flexibility in coverage options, the company strives to meet the diverse needs of its policyholders. Whether you're seeking temporary protection or long-term planning, American Fidelity can offer a solution that aligns with your objectives and provides peace of mind for the future.

-

Financial Challenges: 5 Credit Card Pitfalls to Avoid in Hard Times

Jan 26, 2024

-

How Summer School Affects Your Financial Aid Status

Nov 26, 2023

-

The Art of Financial Optimization: Cheapest to Deliver (CTD) Unveiled

Dec 29, 2023

-

Essentials of Bird Dogging in Real Estate for Beginners and Field Pros

Dec 22, 2023

-

Best Community College Student Loans

Dec 15, 2023

-

Online Commodity Trading: A Beginner's Guide

Dec 30, 2023

-

How To Use Cash-Out Refinance Calculator

Oct 28, 2023

-

Buying a Leased Car

Oct 21, 2023

-

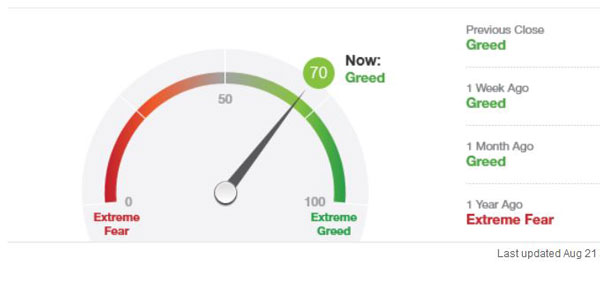

How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023

-

What Is Contractors Professional Liability Insurance?

Nov 19, 2023

-

How Long Is An Appraisal Good For?

Jan 07, 2024

-

What Exactly Is a Working Capital Loan?

Dec 16, 2023