Oct 21, 2023 By Susan Kelly

The price that the leasing company is requesting is certainly a significant element. Some general perks come along with acquiring your current car. First, you have the edge over most people who purchase used cars because you know the vehicle's history. This is particularly true if you treat the car like a princess while in your care. How to buy a leased car?

Are you the kind of motorist that makes it a point to have their oil changed exactly when the manufacturer recommends it? Do you store your car in a garage throughout the year to preserve its exterior in pristine condition? If this is the case, you will buy a car you are certain is in very good condition. If you haven't taken especially good care of the car, buying it might be beneficial in the long run. When you lease a car, most companies charge additional costs for unexpected wear and tear on the vehicle, which may be discovered during the inspection. Keeping the car rather than selling it is one option to avoid incurring that additional cost.

Those who drive their vehicles a significant number of miles over the lease may find that buying the car at the end of the term is the most cost-effective option. In most cases, these contracts include an annual mileage restriction, and if you go over that limit, you will be billed a flat price for each additional mile driven. Consider, for instance, a leasing agreement for three years with a maximum mileage allowance of 12,000. The leasing firm anticipates that you will return the car to them with less than 36,000 miles on the odometer when the lease term ends.

But let's imagine you take extended travels regularly and that you piled up 45,000 miles during that period. If the overage price on your lease is $0.15 per mile, you will owe an additional $1,350 when you turn in the car. However, overage rates may go as high as $0.25 per mile. Because you have purchased the car, you do not need to be concerned about paying that extra price.

How Much Does it Cost to Buy a Leased Car?

The possible advantages outlined above are just one of the factors to consider. After asking themselves, "Do I want a new car?" the most important question most motorists ask is whether or not the purchase price represents a fair bargain. Most car leases will contain a "buyback price," which is the amount you have to pay at the end of the contract if you want to keep the vehicle. The fact that this repurchase price is established before you begin your lease is a peculiarity of the leasing market that you should be aware of.

The reason for this is that for the leasing company to figure out how much your monthly payments will be, they need to estimate how much the car will decrease in value over the life of the contract. Your regular payment is calculated by taking the total amount due on the lease, subtracting the amount that the car will be worth at the end of the term, and then dividing that total by the number of months remaining on the agreement.

Take, for example, a four-door vehicle that retails brand new for $25,000. The leasing company anticipates the car's value will increase to $15,000 over three years. This residual value of $15,000 will be the foundation for the price at which the car may be bought again. Certain leases include a buyout charge, which might result in a marginal increase in the overall cost.

However, here's the catch: there are situations when the company's estimate needs to be more accurate. It isn't easy to accurately forecast all of the elements that might affect resale value several years in advance. A comparison between the buyback price from your lease and the current market value of the car is something you should do before determining whether or not to purchase leased car you now have.

Negotiating the Price

There is a good chance that negotiating with the leasing firm will not provide the desired results. This is particularly true with brand-specific leasing businesses, which are known for maintaining a consistent stance on the repurchase price of the vehicles they lease out. You may succeed more if the leasing firm is a financial institution like a bank or credit union.

Keep in mind that these lenders will have to get rid of that car somehow, whether by selling it to a dealership or putting it up for auction. Sometimes, they want to avoid the hassle and cost of selling the car to a new buyer, which might be a factor in their decision to do so. As a result, it would be worthwhile to investigate who is underwriting your contract and attempt negotiation.

-

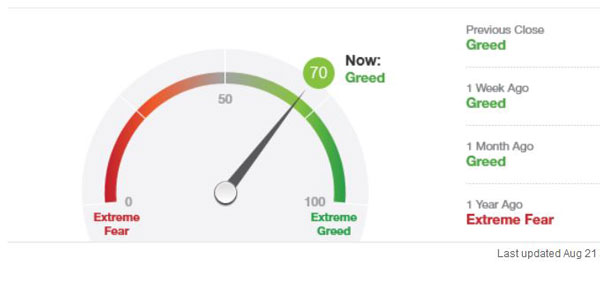

How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023

-

The Quick Guide to Temporary Car Insurance: Finding Short-term Coverage

Feb 01, 2024

-

Buying a Leased Car

Oct 21, 2023

-

The Best Prepaid Debit Cards Of 2022

Jan 21, 2024

-

Reverse Mergers Advantages and Disadvantages

Feb 12, 2024

-

Review of The Gap Visa Card

Dec 04, 2023

-

What Is Contractors Professional Liability Insurance?

Nov 19, 2023

-

What Exactly Is a Working Capital Loan?

Dec 16, 2023