Dec 16, 2023 By Susan Kelly

The term "working capital loan" refers to the type of finance used to cover the ongoing costs of running a firm. Paying employees, settling debts, replenishing goods, and keeping up with the rent are all examples. Lenders in the form of banks, credit unions, and even internet money lenders generally provide working capital loans.

Rates as high as 99% per year are not unheard of, and they may be cheaper than those on longer-term company loans. However, especially with internet lenders, the prerequisites for approval may be lower than those for long-term business loans.

When a Working Capital Loan May Be Necessary

A working capital loan may be a good option for company owners who have trouble making ends meet. Business owners need to remember that working capital loans shouldn't be used to pay off debt or invest in capital-intensive machinery. The following are some examples of when a business owner would want to consider obtaining a working capital loan:

- Until overdue bills are cleared, the company requires capital to support basics like payroll and rent.

- The company's revenue rises and falls with the seasons or other cycles.

- The demand for manufacturing increases during slow months, and the company must find a way to pay for it even while profits are down.

Variety of Loans for Working Capital

Loans against a company's future earnings are known as "working capital," They may assist its owners in dealing with short-term cash flow problems, revenue dips, and payroll obligations. In addition, company owners have access to various working capital lending options such as term loans, lines of credit, SBA loans, and invoice factoring to fulfill these varying demands.

Term Loans

A term loan is a form of financing often granted for a specific time frame (anything from a few months to 25 years) by a financial institution such as a bank or online lender. Most loans vary from $2,000 to $500,000, and interest rates can range from 6% to 99%.

Lines of Credit for Businesses

A business line of credit allows the borrower to access a predetermined credit limit whenever needed. The draw term, which can run up to five years, allows the business owner to withdraw funds from the line of credit as needed. APRs can go as high as 99%, and credit limits can range from $2000 to $250,000.

SBA Loans

Loans guaranteed by the Small Business Administration of the United States are available to anyone who need them to set up, operate, or expand a small business. Lending amounts, periods, and interest rates vary among the various SBA loan programs due to differences in their target audiences, required collateral, and other factors.

Factoring of Invoices

It is common practice for businesses to sell their unpaid bills to a third-party invoice factoring firm for a fee in exchange for an agreed-upon percentage of the entire amount of those invoices. Once an invoice is sold to a factoring business, it is the responsibility of the factor to collect payment. After the factoring company collects the bills, the business receives the remaining monies and fewer costs.

Applying For A Short-Term Loan

The steps required to secure a working capital loan vary greatly between loan types and financial institutions. There are, however, several procedures that are standard when applying for a loan of this type. To obtain a working capital loan, generally follow these steps:

Evaluate Loan Needs

If you think your company could use some extra cash, a working capital loan might be the way. Think about how much money you can put down each month and if you'd be better off with a lump amount or an open line of credit.

Check Personal And Business Credit

Lenders will look at your business's credit history and personal credit profile if you have one. Get sure to look through your test results before applying to see how likely you are to be accepted. Your personal FICO score must be at least 530 to be considered for a working capital loan. However, better rates and conditions become available at the 600-point threshold and above.

Compare Loans

Once you have determined how much money you need to borrow and whether or not you will be approved, you can begin looking for a lender who offers loans in quantities and with restrictions that meet your standards.

Check out the interest rates, repayment plans, and fees from various financial institutions, including banks, credit unions, and internet lenders. Next, investigate each potential lender by reading testimonials from past borrowers.

Collect Paperwork

Lender-specific documentation requirements are possible. To get a business loan, though, you'll need to provide your tax returns for the last two years and your personal and company bank records for the past 12 months.

-

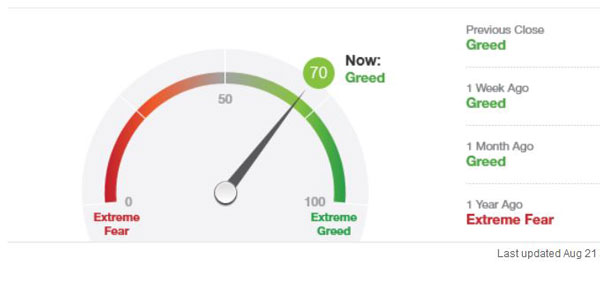

How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023

-

Best Handyman Insurance Companies: Coverage and Client Satisfaction

May 17, 2024

-

How Summer School Affects Your Financial Aid Status

Nov 26, 2023

-

Total Visa Credit Card

Nov 30, 2023

-

A Complete Guide About Perpetual Preferred Stock

Oct 07, 2023

-

How Much Do House Repairs Cost?

Jan 28, 2024

-

Discount Brokers vs. Mutual Fund Companies

Oct 10, 2023

-

The Art of Financial Optimization: Cheapest to Deliver (CTD) Unveiled

Dec 29, 2023