Jan 21, 2024 By Triston Martin

A prepaid debit card is a debit card that you load with cash before you use it. It doesn't need to be linked to a bank account. Once you get the card, you put money on it. Then, you can utilize it to buy things in person or on an online platform. People who don't like traditional bank accounts can use these instead. Payments may be made online with no overdraft fees, and mobile check deposits and direct deposits are also available with some of the best prepaid debit cards. It's also easy to use, and they don't charge for reloading. They also have extra features, like sub-accounts as well as fraud protection.

The 6 Best Prepaid Debit Cards

Prepaid cards that can be reloaded have no annual, monthly, or even refilling fees. If you want a prepaid card that you can trust, any of the cards we've talked about are great options. In reality, the vast majority of them originates from well-known financial companies like Visa, American Express, as well as MasterCard, among others. Take a look at some of these cards' best features and consider which one is best for your needs.

1. Bluebird By American Express

Everyone knows about American Express, a big name in the US financial world. It's also one of the most common credit card providers. Having an American Express card there in the past, or even having one in your wallet at the moment, is very likely. With the introduction of Bluebird prepaid debit cards, this premium brand is giving even more value to its clients. With no fees, these are the best prepaid debit cards available.

To keep track of your money with the Bluebird by American Express card, all you have to do is: A well-designed app lets you deposit money, pay your bills, and transfer money to all other Bluebird by American Express customers. If you don't have an Android or iOS device, you don't have to worry about it not working with the app.

2. Mango Prepaid Mastercard®

The Mango Prepaid Mastercard® is the only prepaid card that will reward you more for setting aside money in a completely separate savings account than any other card will. As long as you have at least $2,500 in your savings account, you can get an annual percentage yield (APY) of up to 6%. As long as you have more than that, you'll get 0.10 percent APY.

If you want to be eligible for the 6 percent annual percentage yield, you'll have to make at least $1,500 in "signature purchases" each month and maintain a minimum balance of $25 in your savings account toward the end of the month. When you make a "signature" purchase, you don't use your PIN to make the sale.

3. Netspend Visa Prepaid Card

If you want to get a prepaid card that doesn't charge you, the NetSpend Visa Prepaid Card is among the best ones. With this card, you won't have to think about overdraft charges, activation charges, credit checks, minimum balances, or any other fees at all. The NetSpend mobile app makes it easy to manage the money on your card, and you can add money to the card by direct deposit or by writing a check. One of the best things about this card is that the FDIC covers it. Use this card to buy things. If your card is lost or stolen, NetSpend makes it easy for you to get a new one.

4. FamZoo Prepaid Card

A family-friendly prepaid Mastercard, FamZoo allows parents to act as virtual bankers for their children, even if they are less than thirteen years old. Each month, four cards can indeed be part of a single plan. You can add more cards for a one-time $3 service charge per card. For example, you can give your child allowances and split payments from the website or app.

You can also see balances on all of their cards, set up text or email alerts, and see how much they've spent. FamZoo costs $59.99 for two years, which works out to about $2.50 per month. Other payment plans also give you a discount. The fee for a month-to-month subscription is $5.99. There are no fees for activation or inactivity, so there are no costs.

5. PayPal Prepaid Mastercard

When eBay bought it in 2002 for $1.5 billion, PayPal was well-known for having Tesla creator Elon Musk as its largest stakeholder. Since then, PayPal has established itself as one of the world's leading players in the online payment sector. The company's prepaid debit card, managed by Netspend and issued by The Bancorp Bank, is meant to be the best companion for PayPal users. There are various methods to fill your PayPal Debit Card at no additional charge. In this case, the company wants you to send money right from your PayPal account fast and free.

The fact that there is no fee associated with using a prepaid debit card for direct deposit makes them some of the most acceptable prepaid debit cards for this reason as well. Additionally, users may use complimentary mobile check deposits. However, processing may take up to ten days. If you want your checks to be cashed quickly, there is a 1% fee for both payrolls as well as government checks.

6. Starbucks Rewards Visa

The Starbucks Rewards Visa Prepaid Card offers $10,000 maximum balance flexibility. You don't have only to buy things at Starbucks with this card. You may use it anywhere where Visa is accepted as a payment option. There are no fees for this card, and if you drink a lot of Starbucks, you can link it to your Starbucks rewards account. Unfortunately, you can't use this card to get cash from an Atm. Additionally, there is a 3% charge for using the card outside the United States, which is why most customers do not suggest this prepaid card for international travel.

Conclusion

The most acceptable prepaid cards are not only excellent budgeting tools, but they can also have a plethora of additional benefits and are reasonably priced. We looked at many things when we made our list, like fees, additional benefits, free reload options and ways to get money back. The cards we choose include unique features such as a high-interest savings account, connectivity with major digital wallets, and an extensive free ATM network.

-

The Long, Weird History of Universal Basic Income—and Why It’s Back

Feb 20, 2024

-

Total Visa Credit Card

Nov 30, 2023

-

How To Use Cash-Out Refinance Calculator

Oct 28, 2023

-

Buying a Leased Car

Oct 21, 2023

-

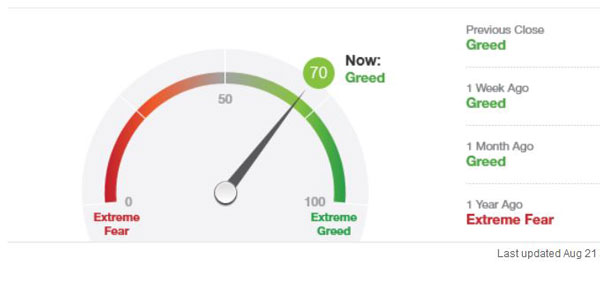

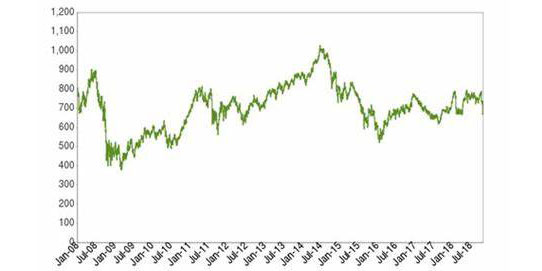

How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023

-

Unlocking the Potential: Investing in Real Estate with Your IRA

Nov 21, 2023

-

What Is Contractors Professional Liability Insurance?

Nov 19, 2023

-

Find Out: What Are the Minimum Number of Shares You Can Buy?

Nov 06, 2023