Feb 20, 2024 By Susan Kelly

On the surface, Martin Luther King, Jr., Napoleon, and Thomas Paine have little in common. It doesn't matter if you're a socialist, a libertarian, or a bureaucracy in Finland or Silicon Valley. The idea that governments should provide their citizens with a basic income tends to bring together some unexpected bedfellows. Without creating jobs or giving traditional welfare, the same amount of money will be cut into checks.

In the last few years, universal basic income (UBI) has gained traction. As algorithms learn to perform more blue- and white-collar tasks, there may not be enough paid work. The prospect of automation is drawing people's attention.

Some proponents of a basic income disregard or reject this bleak possibility. He said, "I appreciate that reasoning," according to a co-chair of the Basic Income Earth Network (BEIN), Karl Widerquist. Nevertheless, I'm concerned about overdoing it.

What Is a Universal Basic Income (UBI)?

Basic income in its purest form is an unrestricted, recurring cash payout from the government to all citizens. As a hedge fund manager and a homeless person receive the same amount, there is no means-testing

Because there are no requirements to work, go to school, get shots, join the military, or vote, a UBI has no ties. Neither housing nor food or vouchers are used to pay for it. As a result, no one's cash income can fall below this level.

Would a basic income only be available to U.S. citizens, or would it also be extended to the country's estimated 11 million undocumented residents?

The Past 100 Years

In the 20th century, the left embraced the idea of a basic income. In 1934, Louisiana senator Huey Long, a populist, advocated a $2,000 minimum wage (as well as a maximum income of 300 times the average).

Oxford political economics professor G.D.H. Cole supported social dividends. In 1953, he coined the phrase "basic income." Guaranteed minimum income became politically mainstream in the 1960s, perhaps ironically at the same time as anthropologists were documenting! Kung and other rapidly disappearing hunter-gatherer tribes. Martin Luther King, Jr, supported it.

New Jersey, Iowa, North Carolina, and Indiana were the states where experiments were carried out. Nixon argued that his "basic Federal minimum" was different from the $1,000 annual demogrant George McGovern would have provided to every American citizen, even though he campaigned for federal law.

During the Reagan-Thatcher era, the political winds altered, and the idea of a basic income became more popular on the far left. Critics of market socialism weighed in on other fringe concepts, such as a coupon-based stock market in which all people would hold dividend-paying shares without the chance to cash out.

Imagining a 21st Century Basic Income

The concept of a "basic income" has re-emerged in the public consciousness. Proponents of the idea come from various ideological backgrounds, which isn't surprising considering the splintered nature of its history. As a general rule, many on the left see it as a cure for poverty and inequality. Increasing the effectiveness of the welfare state is the main reason it appeals to the right.

Reformers who want to rationalize policy in light of present challenges are distinguished from futurists who wish to completely reshape society or prevent it from being completely reshaped by automation. Any particular advocate for basic income will likely use a variety of these arguments in practice, regardless of political taxonomy.

Fix Welfare's Perverse Incentives

The current welfare model is frequently attacked for pushing users to act in ways the program's designers never intended or contrary to common sense.

Philippe van Parijs and Yannick Vanderborght take up this criticism in their book, Basic Income, stating that welfare ensnares beneficiaries (via means testing and work requirements) and has to be changed.

The employment trap prevents recipients from quitting their jobs, regardless of the therapy they get. An unrestricted labor pool is provided to bad employers, preventing them from negotiating better wages or working conditions. Welfare inadvertently creates a jobless cycle. At the 100% marginal rate in some cases, welfare claimants' extra earnings are taxed at the same rate as their benefits. It's a glaring irrational choice to work when the rate can reach 100% (a welfare cliff).

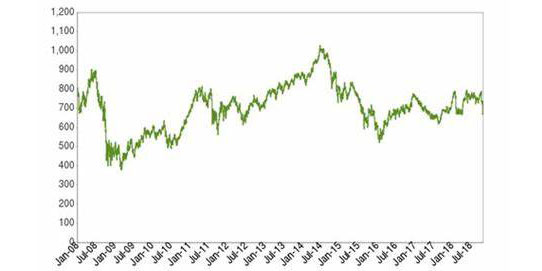

Finland completed a two-year trial in basic income in December 2018 to alleviate the unemployment crisis. 2,000 working-age unemployed people received €560 ($635) a month from the country's welfare administration. The experiment did not alter their eligibility for further unemployment benefits, nor did it influence their ability to obtain the basic benefit. Basic income users were more satisfied and healthier than they were on unemployment, but it did not affect their jobless status.

-

Reverse Mergers Advantages and Disadvantages

Feb 12, 2024

-

Find Out: What Are the Minimum Number of Shares You Can Buy?

Nov 06, 2023

-

Navigating Through the Insurance: A Guide for E-Commerce Businesses

Jan 31, 2024

-

The Art of Financial Optimization: Cheapest to Deliver (CTD) Unveiled

Dec 29, 2023

-

The Long, Weird History of Universal Basic Income—and Why It’s Back

Feb 20, 2024

-

Who Should Get Settlers Life Insurance?

May 10, 2024

-

How Much Do House Repairs Cost?

Jan 28, 2024

-

Online Commodity Trading: A Beginner's Guide

Dec 30, 2023